All Categories

Featured

Table of Contents

Selecting to spend in the property market, stocks, or other common sorts of assets is sensible. When making a decision whether you must spend in accredited investor opportunities, you need to stabilize the compromise you make between higher-reward possible with the lack of coverage demands or regulative openness. It needs to be said that exclusive positionings entail higher degrees of danger and can fairly usually represent illiquid investments.

Especially, nothing right here should be translated to state or imply that past outcomes are a sign of future performance neither must it be interpreted that FINRA, the SEC or any other safeties regulator accepts of any one of these safety and securities. Furthermore, when assessing private positionings from sponsors or business providing them to recognized financiers, they can provide no service warranties revealed or suggested regarding precision, efficiency, or results obtained from any kind of info supplied in their discussions or presentations.

The firm should offer info to you with a document called the Personal Placement Memorandum (PPM) that offers a much more in-depth description of costs and risks associated with taking part in the financial investment. Passions in these deals are only offered to persons who certify as Accredited Investors under the Stocks Act, and a as defined in Section 2(a)( 51 )(A) under the Business Act or an eligible staff member of the administration business.

There will not be any kind of public market for the Passions.

Back in the 1990s and very early 2000s, hedge funds were recognized for their market-beating efficiencies. Usually, the supervisor of an investment fund will certainly set apart a section of their available assets for a hedged bet.

What is included in Accredited Investor Rental Property Investments coverage?

For instance, a fund supervisor for an intermittent market might commit a portion of the assets to stocks in a non-cyclical sector to offset the losses in instance the economy containers. Some hedge fund managers use riskier methods like making use of borrowed cash to acquire even more of a possession simply to increase their prospective returns.

Comparable to common funds, hedge funds are expertly managed by profession investors. Hedge funds can apply to different investments like shorts, choices, and derivatives - Accredited Investor Real Estate Income Opportunities.

Can I apply for Real Estate Syndication For Accredited Investors as an accredited investor?

You may choose one whose investment viewpoint straightens with yours. Do bear in mind that these hedge fund cash supervisors do not come economical. Hedge funds generally charge a fee of 1% to 2% of the properties, in addition to 20% of the earnings which works as a "efficiency cost".

High-yield financial investments bring in many capitalists for their cash money flow. You can buy a property and obtain awarded for keeping it. Accredited financiers have much more chances than retail capitalists with high-yield financial investments and beyond. A higher selection offers certified investors the possibility to get greater returns than retail capitalists. Certified financiers are not your normal financiers.

Why are Accredited Investor Real Estate Deals opportunities important?

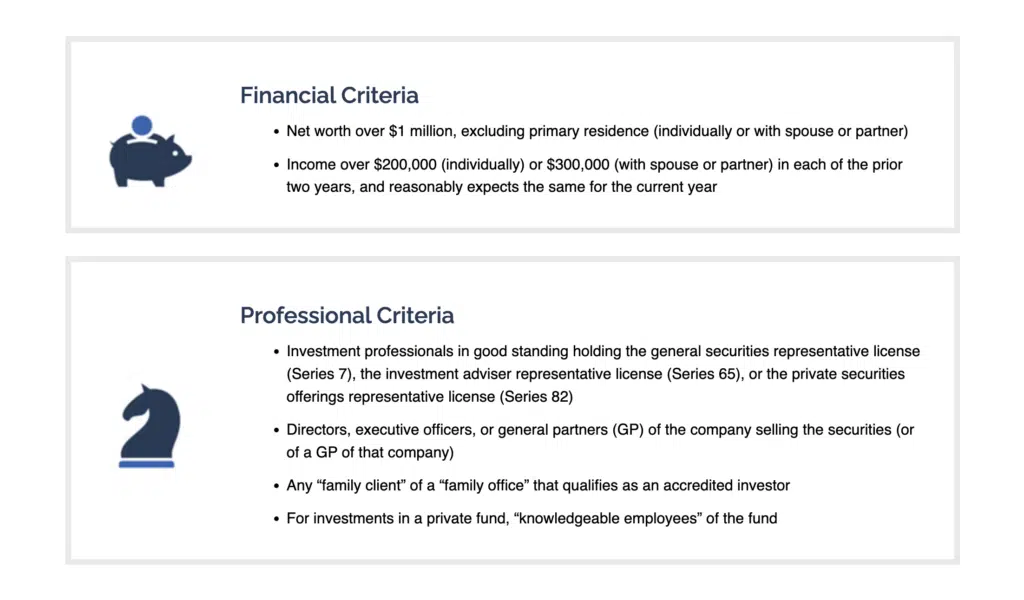

You should accomplish at least one of the complying with parameters to end up being a recognized investor: You need to have over $1 million internet worth, excluding your main residence. Business entities count as accredited capitalists if they have over $5 million in properties under administration. You have to have a yearly revenue that surpasses $200,000/ yr ($300,000/ yr for partners filing with each other) You should be an authorized financial investment expert or broker.

Therefore, recognized capitalists have more experience and cash to spread across assets. Accredited capitalists can seek a wider variety of assets, however much more options do not assure greater returns. Most financiers underperform the marketplace, consisting of accredited financiers. Regardless of the greater status, certified investors can make considerable errors and do not have access to expert info.

In enhancement, financiers can construct equity with favorable money circulation and residential property recognition. Genuine estate residential or commercial properties require considerable upkeep, and a great deal can go wrong if you do not have the appropriate group.

Accredited Investor Real Estate Deals

Real estate organizations merge money from accredited financiers to acquire homes lined up with well established purposes. Accredited financiers merge their cash together to fund acquisitions and building advancement.

Actual estate investment depends on must distribute 90% of their taxable income to investors as dividends. You can get and sell REITs on the stock market, making them a lot more fluid than a lot of financial investments. REITs permit capitalists to branch out promptly across many residential or commercial property classes with really little resources. While REITs likewise turn you right into a passive investor, you obtain more control over essential decisions if you join a property syndicate.

Who offers the best Real Estate Investment Partnerships For Accredited Investors opportunities?

Financiers will profit if the supply cost climbs because convertible investments offer them more eye-catching entry factors. If the stock topples, capitalists can choose versus the conversion and secure their finances.

Table of Contents

Latest Posts

Buying Back Tax Properties

Land Tax Sales

Tax Lien Investing Scam

More

Latest Posts

Buying Back Tax Properties

Land Tax Sales

Tax Lien Investing Scam