All Categories

Featured

Table of Contents

Pros Accessibility to more investment opportunities High returns Boosted diversity Disadvantages Risky financial investments High minimum financial investment amounts High efficiency fees Lengthy capital secure time The key advantage of being a certified capitalist is that it provides you an economic benefit over others. Due to the fact that your internet worth or wage is currently among the greatest, being an approved financier enables you accessibility to investments that others with less riches do not have accessibility to.

One of the simplest instances of the benefit of being a certified investor is being able to invest in hedge funds. Hedge funds are mostly only available to recognized financiers due to the fact that they require high minimum financial investment quantities and can have higher connected dangers but their returns can be phenomenal.

There are likewise disadvantages to being a recognized investor that relate to the financial investments themselves. Most financial investments that need an individual to be a certified financier come with high danger. The approaches employed by numerous funds featured a greater threat in order to achieve the objective of beating the marketplace.

Just transferring a few hundred or a couple of thousand bucks right into a financial investment will certainly refrain. Accredited capitalists will need to commit to a couple of hundred thousand or a couple of million bucks to take part in financial investments suggested for recognized investors. If your financial investment goes south, this is a great deal of cash to shed.

These mostly come in the form of performance charges along with monitoring costs. Performance charges can range in between 15% to 20%. One more disadvantage to being a certified investor is the capacity to access your investment capital. If you acquire a couple of supplies online via an electronic system, you can pull that money out any type of time you like.

Being an accredited investor comes with a great deal of illiquidity. They can also ask to assess your: Financial institution and various other account statementsCredit reportW-2 or various other earnings statementsTax returnsCredentials issued by the Financial Market Regulatory Authority (FINRA), if any type of These can aid a company figure out both your economic credentials and your elegance as a capitalist, both of which can affect your condition as an accredited capitalist.

Residential Real Estate For Accredited Investors

An investment automobile, such as a fund, would have to establish that you qualify as an approved investor. The benefits of being an approved investor consist of access to distinct investment possibilities not readily available to non-accredited financiers, high returns, and raised diversity in your portfolio.

In certain regions, non-accredited financiers additionally have the right to rescission. What this implies is that if a capitalist chooses they desire to pull out their cash early, they can claim they were a non-accredited capitalist during and get their money back. Nevertheless, it's never ever a great idea to supply falsified documents, such as fake income tax return or monetary declarations to an investment vehicle simply to spend, and this could bring legal difficulty for you down the line.

That being said, each bargain or each fund may have its very own constraints and caps on investment quantities that they will approve from a financier. Certified investors are those that fulfill particular demands regarding revenue, credentials, or internet worth. They are usually well-off people. Accredited investors have the possibility to invest in non-registered investments offered by firms like exclusive equity funds, hedge funds, angel financial investments, equity capital companies, and others.

When you end up being a recognized financier, you are in the elite group of individuals who have the monetary methods and governing clearance to make investments that can not. This can indicate unique access to hedge funds, financial backing companies, specific mutual fund, exclusive equity funds, and more. The Stocks and Exchange Payment argues by ending up being an approved financier, you possess a degree of sophistication capable of constructing a riskier financial investment portfolio than a non-accredited financier.

It's also focused on a very specific specific niche: grocery-anchored commercial property (Accredited Investor Real Estate Investment Groups). FNRP's team leverages relationships with top-tier national-brand tenantsincluding Kroger, Walmart, and Whole Foodsto give financiers with access to institutional-quality CRE deals both on- and off-market. Unlike a lot of the other sites on this list, which are equity crowdfunding platforms, FNRP supplies private positionings that just a recognized financier can accessibility

Who has the best support for High-return Real Estate Deals For Accredited Investors investors?

Yieldstreet $2,500 All Capitalists generally, any possession that drops outside of supplies, bonds or cashhave come to be significantly preferred as fintech services open up previously closed markets to the private retail investor. These opportunities have equalized various markets and unlocked formerly unattainable cash flows to pad your income.

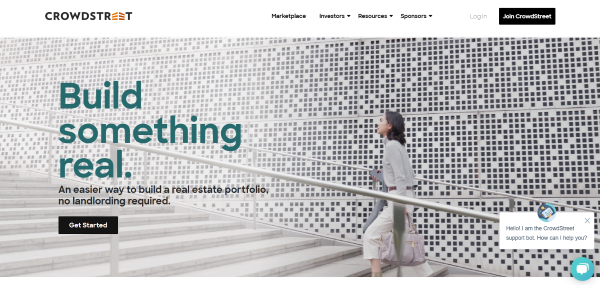

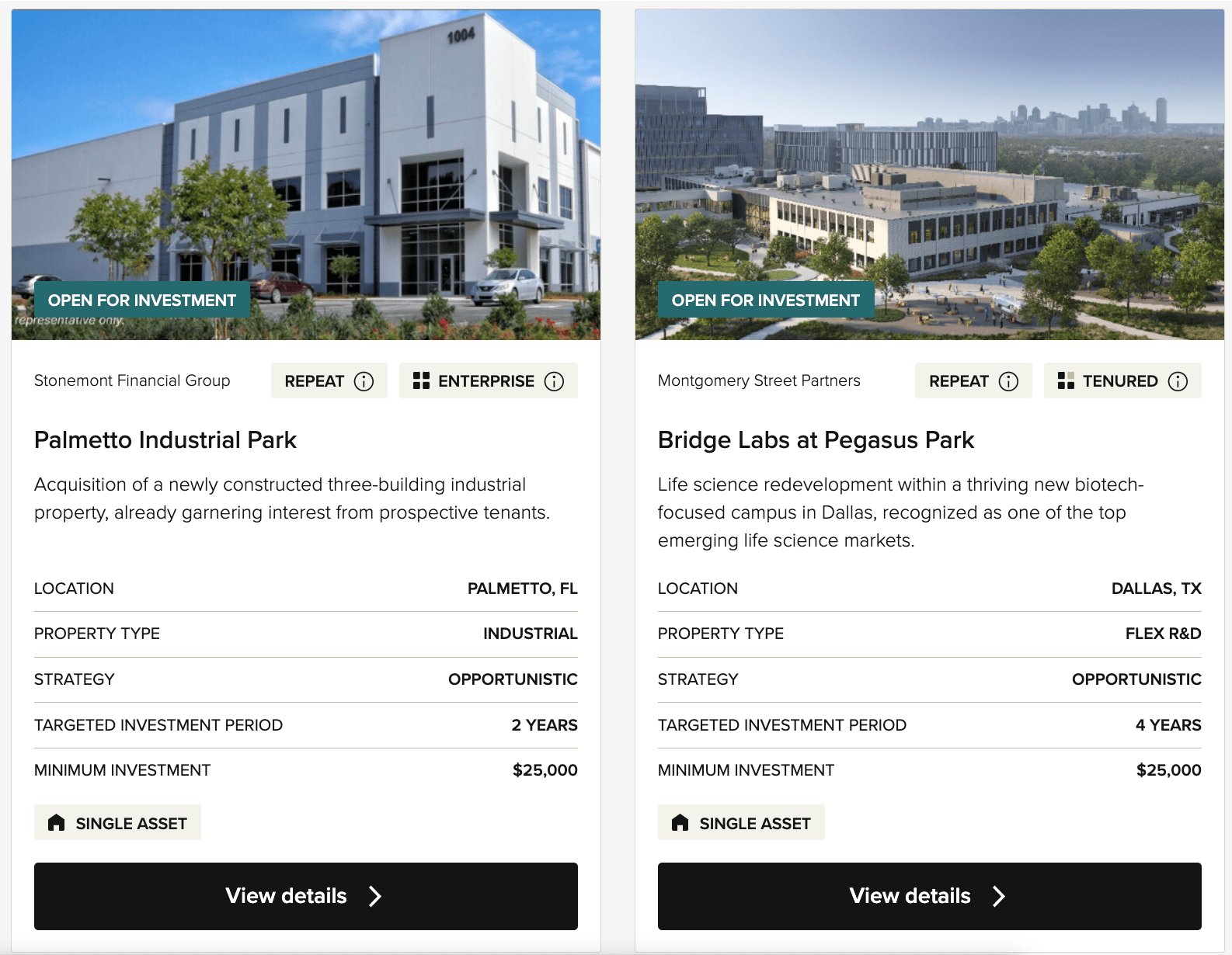

Nonetheless, you must be a certified capitalist to take part in all other Yieldstreet offerings. Learn extra, and take into consideration accessing these easy income financial investments, by today. EquityMultiple $5,000 Accredited Investors Only Some property crowdfunding systems just permit you to buy property portfolios. Nevertheless, some systems, such as, likewise permit you to buy private propertiesin this situation, commercial realty (CRE).

Nonetheless, those investors have access to specific business actual estate deals, funds, and even varied temporary notes. Particularly, EquityMultiple only enables its specific commercial realty projects to receive investments from certified capitalists. For those interested in finding out even more concerning, consider enrolling in an account and undergoing their certification procedure.

Table of Contents

Latest Posts

Buying Back Tax Properties

Land Tax Sales

Tax Lien Investing Scam

More

Latest Posts

Buying Back Tax Properties

Land Tax Sales

Tax Lien Investing Scam