All Categories

Featured

Table of Contents

Like numerous various other crowdfunding websites, FNRP hosts a live webinar before each offer launch. In them, a firm board walks via the deal information and solutions any inquiries to aid financiers much better recognize the investment. From there, financiers get access to possession efficiency reports, lease updates, and various other asset-specific information, including on mobile applications for Android and Apple.

The business additionally assists financiers do 1031 exchanges to delay paying funding gains taxes. On its site, FNRP claims it's dispersed $100 million to capitalists considering that 2015, earning an internet IRR of 15%.

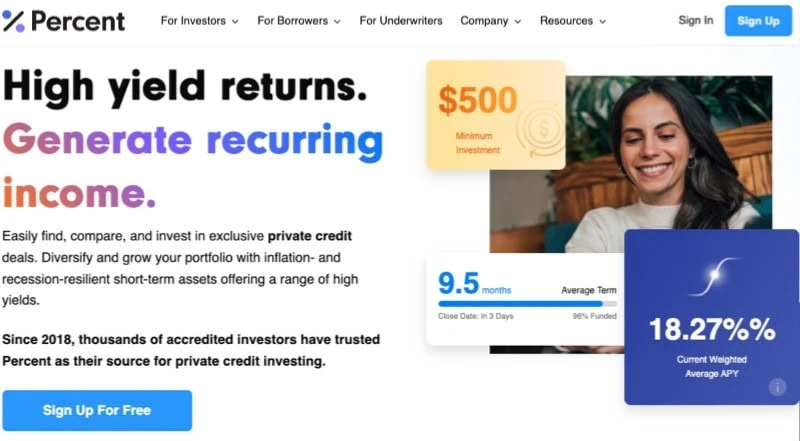

Customer solution is offered from 9 am 6 pm ET. EquityMultiple boasts a breadth of offerings amongst 167 unique markets and 123 sponsor/operator companions. The firm has actually deployed over $570M in financier funding and $379M in complete circulations - Real Estate Investment Funds for Accredited Investors. EquityMultiple is a wonderful alternative for investors looking for accessibility to equity, favored equity, and elderly financial obligation throughout many CRE home types.

Expanding its extent, Yieldstreet has branched out into numerous financial investment methods, encompassing funding for commercial and domestic home transactions, commercial finances like seller cash breakthroughs, purchase of oil tankers, and investment in great art. Financiers get passion settlements and the return of their principal financial investment throughout the funding duration. Many possibilities have investment minimums in between $10,000 and $20,000, with target hold durations differing by offering.

What is included in Commercial Property Investments For Accredited Investors coverage?

:max_bytes(150000):strip_icc()/Real-Estate-Investment-Trust-189c6cf51a03412b880b12f10ff1ee05.jpg)

While most investments are offered only to accredited investors, the Growth & Earnings REIT and the Yieldstreet Option Revenue Fund are additionally available to non-accredited financiers, with both having an investment minimum of $10,000. The Yieldstreet Option Earnings Fund purchases many alternate asset courses with a single investment, while the REIT offers access to a diversified mix of realty investments.

One unique function of Yieldstreet is its Budget item, an FDIC-insured checking account that makes 3.25% yearly rate of interest on funds held. Financiers can pre-fund their account prior to investing, and the funds will certainly be held within this interest-bearing monitoring account. The company web site has a chatbot for asking Frequently asked questions or sending out messages, a contact e-mail address, and an Assistance.

These capitalists have contributed even more than $3.9 billion to Yieldstreet offerings. Yieldstreet has a track document of over $2.4 billion of complete bucks returned to financiers, with 85% of offerings having actually attained within 0.5% of their target. The system supplies appealing tax obligation advantages for genuine estate investors.

Its web site specifies the system has offered over $2.1 B in securities throughout even more than 1.5 K exchange purchases. Since this writing, the system likewise has over 70 active investment opportunities listed. Unlike various other crowdfunding systems that make use of LLCs, many 1031 Crowdfunding deals are housed within a Delaware Statutory Depend On (DST), which allows fractional ownership in buildings and the deferment of capital gains tax obligations after residential or commercial property sales.

Many bargains are open to certified financiers just. Nevertheless, some REITs and general genuine estate funds are open to non-accredited investors. Commercial Real Estate for Accredited Investors. Registered customers can log right into the online 1031 Crowdfunding portal to track key performance metrics and gain access to vital investment documents such as residential or commercial property PPMs, tax viewpoints, economic projections, appraisals, and financing details

What is the best way to compare Real Estate Investment Networks For Accredited Investors options?

For assistance, individuals can fill in a contact type on the business's web site or call the listed telephone number. On the whole, 1031 Crowdfunding is a fantastic choice for financiers who wish to minimize their tax obligation worry with 1031 exchanges and DSTs. There's no one-size-fits-all realty crowdfunding platform. The ideal choice will certainly rely on the kinds of assets, investments, returns, and income regularity you want.

Moreover, genuine estate crowdfunding is below to say. According to Vantage Marketing Research, the global realty crowdfunding market was valued at $11.5 billion in 2022 and is projected to reach a worth of $161 billion by 2030, registering a substance annual growth price (CAGR) of 45.9% between 2023 and 2030.

We assessed the sort of financial investment, consisting of residential property type, holding durations, and withdrawal terms. We confirmed the minimum amount needed to invest on the system (Real Estate Investing for Accredited Investors). We weighed what fees are related to spending for the system, including sourcing, administration, and various other charges. We examined exactly how easy it is to track a financial investment's efficiency on the system.

These suggestions are based upon our direct experience with these firms and are suggested for their efficiency and effectiveness. We suggest only acquiring items that you believe will aid within your business objectives and investment goals. Nothing in this message need to be considered as financial investment advice, either on behalf of a particular protection or concerning a general financial investment strategy, a recommendation, a deal to sell, or a solicitation of or a deal to purchase any protection.

Accredited Investor Real Estate Syndication

For any questions or assistance with these sources, really feel cost-free to get in touch with. We're right here to help!.

Property is an efficient and potentially rewarding means to branch out an investment portfolio. It has likewise been commonly out of reach for little financiers due to the big resources requirements. The most effective property financial investment apps have changed that and opened new possibilities. Dive to: Right here are some applications that can assist you add realty to your profile without extreme prices.

The only downside is that you need to be accredited to accessibility a lot of the cooler things. Review extra $10,000 Growth and Income REIT and YieldStreet Prism Fund; Varies for various other investments0 2.5% annual management charges; Added charges differ by investmentREITs, funds, property, art, and various other alternative investmentsVaries by financial investment DiversyFund gives day-to-day investors an opportunity to get an item of the multifamily home pie.

You can still go with the old-school technique if you want, yet it's no more the only means to go. A variety of apps and solutions have arised recently that guarantee to democratize access to actual estate investing, offering also small-time financiers the possibility to acquire right into and benefit off of huge residential properties.

Are there budget-friendly Private Real Estate Deals For Accredited Investors options?

They act as a kind of business genuine estate matchmaking solution that links recognized financiers to enrollers looking for resources. There generally aren't that several deals available on their industry at any type of provided time (though this depends greatly on the general genuine estate market), but in a means, that's kind of an excellent thing.

Simply put, they aren't worried to deny offers that they do not assume are good enough for their users. Though the platform is totally free, easy to use, and takes a whole lot of the frustration out of business actual estate investing, it isn't excellent. There are two primary disadvantages: the rather significant minimum financial investment of $25,000 and the truth that it's restricted to recognized financiers.

Table of Contents

Latest Posts

Buying Back Tax Properties

Land Tax Sales

Tax Lien Investing Scam

More

Latest Posts

Buying Back Tax Properties

Land Tax Sales

Tax Lien Investing Scam