All Categories

Featured

Table of Contents

As recognized capitalists, people or entities may take part in personal financial investments that are not signed up with the SEC. These capitalists are presumed to have the financial class and experience required to assess and purchase high-risk investment possibilities hard to reach to non-accredited retail capitalists. Right here are a few to consider. In April 2023, Congressman Mike Flooding presented H.R.

For currently, investors should follow the term's existing meaning. There is no official process or federal qualification to come to be a certified financier, a person might self-certify as an approved financier under current regulations if they gained even more than $200,000 (or $300,000 with a spouse) in each of the previous two years and expect the same for the existing year.

People with an active Collection 7, 65, or 82 certificate are additionally thought about to be accredited financiers. Entities such as companies, partnerships, and counts on can additionally attain certified capitalist standing if their investments are valued at over $5 million.

What does a typical High-yield Real Estate Investments For Accredited Investors investment offer?

Right here are a few to take into consideration. Private Equity (PE) funds have actually shown amazing development recently, seemingly undeterred by macroeconomic difficulties. In the third quarter of 2023, PE offer quantity exceeded $100 billion, roughly on the same level with deal activity in Q3 of the previous. PE companies pool resources from accredited and institutional financiers to get managing interests in mature personal companies.

In addition to funding, angel investors bring their professional networks, guidance, and competence to the startups they back, with the assumption of endeavor capital-like returns if the company removes. According to the Center for Endeavor Research study, the typical angel financial investment amount in 2022 was roughly $350,000, with financiers receiving a typical equity stake of over 9%.

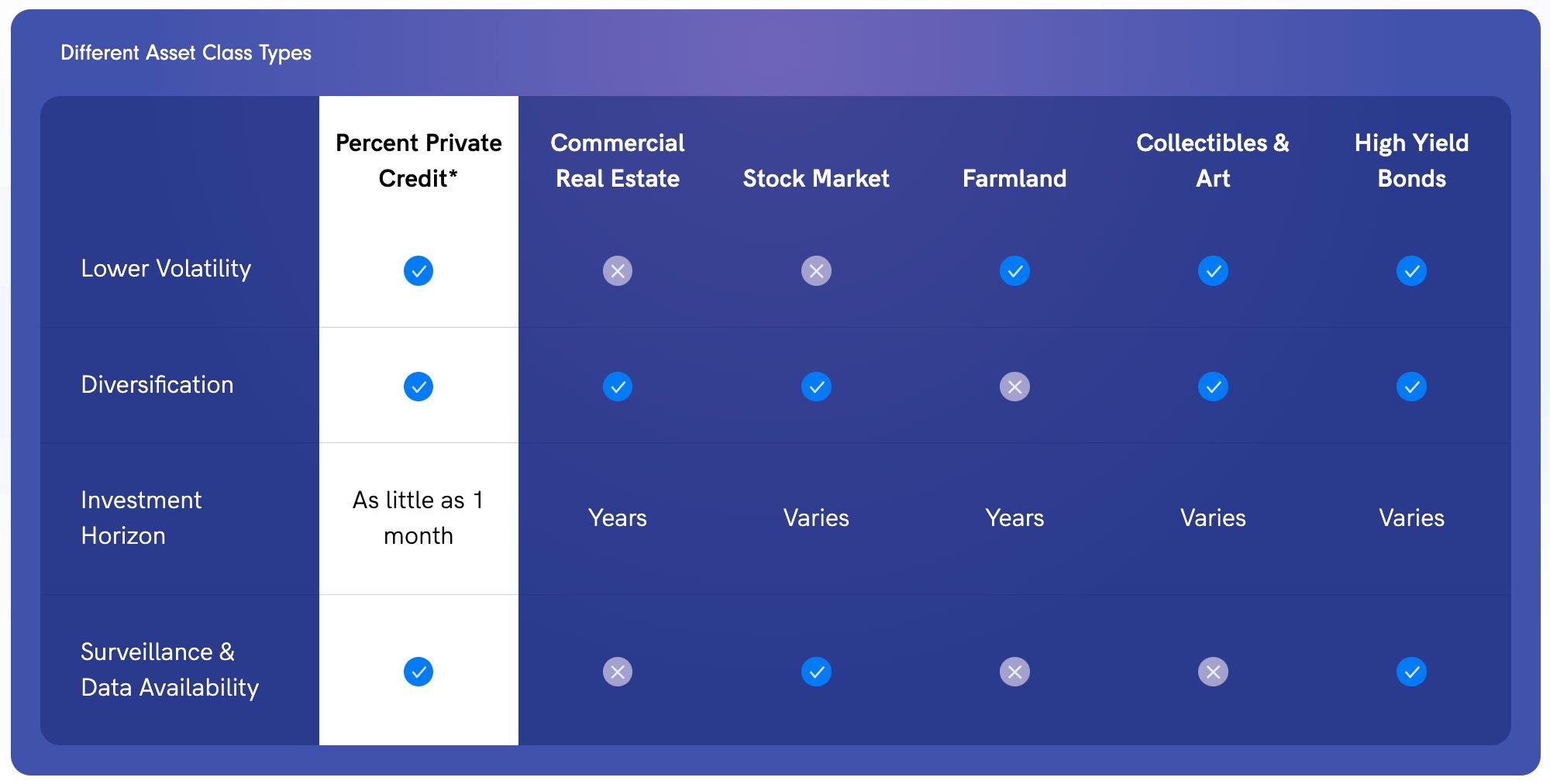

That claimed, the development of online private credit systems and specific niche enrollers has made the asset course accessible to specific recognized financiers. Today, financiers with just $500 to invest can take advantage of asset-based personal credit score possibilities, which provide IRRs of as much as 12%. Despite the rise of e-commerce, physical grocery shops still account for over 80% of grocery store sales in the United States, making themand especially the property they run out oflucrative financial investments for recognized capitalists.

In contrast, unanchored strip centers and area centers, the next 2 most heavily transacted sorts of real estate, tape-recorded $2.6 billion and $1.7 billion in transactions, respectively, over the very same period. What are grocery store store-anchored? Suv strip malls, electrical outlet shopping centers, and various other retail facilities that feature a major grocery shop as the location's main tenant commonly fall under this classification, although malls with encased walkways do not.

Accredited capitalists can invest in these rooms by partnering with genuine estate personal equity (REPE) funds. Minimum financial investments normally start at $50,000, while overall (levered) returns range from 12% to 18%.

What is the process for investing in Real Estate Investment Networks For Accredited Investors?

Over the last decade, art has actually made typical annual returns of 14%, trouncing the S&P 500's 10.15%. The marketplace for art is likewise expanding. In 2022, the global art market grew by 3% to $67.8 billion. By the end of the decade, this figure is anticipated to come close to $100 billion.

Investors can now own diversified personal art funds or acquisition art on a fractional basis. These options come with financial investment minimums of $10,000 and supply web annualized returns of over 12%.

If you have actually seen advertisements for real estate investments, or any kind of other form of investing, you may have seen the term "recognized" prior to. Some financial investment opportunities will just be for "certified" investors which are 506(c) offerings. Regrettably, this leads some people to think that they can not spend in property when they can (after all, "accredited" sounds like something you earn or apply for).

How much do Accredited Investor Real Estate Crowdfunding options typically cost?

Maybe there's a restaurant down the road that you desire to spend in to obtain a 25% equity stake. That restaurant can obtain financial investments from recognized financiers yet not nonaccredited ones.

:max_bytes(150000):strip_icc()/Real-Estate-Investment-Trust-189c6cf51a03412b880b12f10ff1ee05.jpg)

Keeping that history in mind, as you may visualize, when someone gets capitalists in a brand-new apartment, they have to often be approved. As with the majority of laws, even that's not constantly the instance (we'll detail a lot more shortly)! There are many various kinds of real estate investing. Much of them are open to nonaccredited capitalists (Accredited Investor Real Estate Deals).

Exactly how is that a nonaccredited real estate investing choice? The answer lies in a nuance of the legislation. A nonaccredited realty investment possibility is a 506(b) offer named after the area of the statute that authorizes it. Syndications under this regulation can not publicly advertise their safeties, so it is required that the sponsors (people putting the submission together) have a preexisting relationship with the capitalists in the bargain.

Probably the most straightforward and instinctive investment chance for someone that does not have accreditation is getting and holding rental residential property. Commonly, home values value, and you can create a steady monthly income stream! Acquiring and holding rental residential properties is possibly the most simple of all the unaccredited actual estate investing options!

Part of the factor these programs are all over is that turning does function mainly. You can discover homes cheaply, remodel them, and offer them for a tidy earnings if you understand where to look. If you go behind the scenes on these programs, you'll often understand that these investors do a lot of the work on their very own.

The concept behind this method is to maintain doing the adhering to actions in succession: Buy a single-family home or apartment that requires some job. Rehab it to make it both rentable and raise the home's value. Rent it out. Re-finance the property to draw out as a lot of your initial resources as possible.

Who provides reliable Private Real Estate Investments For Accredited Investors options?

What if you don't have that saved up yet however still desire to spend in actual estate? These companies commonly buy and run shopping centers, shopping facilities, apartment buildings, and various other large real estate investments.

Table of Contents

Latest Posts

Buying Back Tax Properties

Land Tax Sales

Tax Lien Investing Scam

More

Latest Posts

Buying Back Tax Properties

Land Tax Sales

Tax Lien Investing Scam